Barclays global aggregate bond index historical returns images are available in this site. Barclays global aggregate bond index historical returns are a topic that is being searched for and liked by netizens today. You can Download the Barclays global aggregate bond index historical returns files here. Get all free images.

If you’re looking for barclays global aggregate bond index historical returns pictures information related to the barclays global aggregate bond index historical returns topic, you have visit the right blog. Our site always gives you hints for viewing the highest quality video and picture content, please kindly hunt and locate more informative video articles and images that match your interests.

Bloomberg Barclays Indices track total returns. The reason the firm chose this index Caroline-Laure Negre fixed income manager at Vanguard says is because it gives a better gauge of liquidity in the market as it removes holdings that. The Bloomberg Barclays US Aggregate Bond Index ticker. 135144 034 038 449. Investors frequently use the index as a stand-in for measuring the performance of the US bond market.

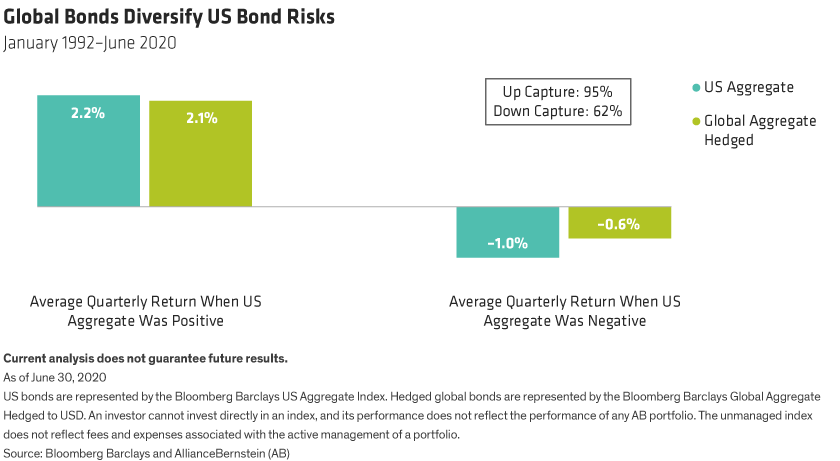

Barclays Global Aggregate Bond Index Historical Returns. The Aggs duration extension comes with less yield cushion as yields have dropped in this low interest rate environment. Going back to 2004 the duration of the Aggregate was shorter 477 years versus 573 today and the yield was higher 464 versus 249. Bloomberg Barclays Indices track total returns. In addition to investment grade corporate debt the index tracks government debt.

Access Global Income Opportunities From franklintempleton.ca

Access Global Income Opportunities From franklintempleton.ca

Treasuries quasi-governments corporates taxable municipal bonds foreign agency supranational federal agency and non-US. The Bloomberg Barclays US Aggregate Bond Index ticker. Going back to 2004 the duration of the Aggregate was shorter 477 years versus 573 today and the yield was higher 464 versus 249. An unmanaged market-weighted index comprised of government and investment grade corporate debt instruments with maturities of one year or greater. In depth view into AGG iShares Core US Aggregate Bond ETF including performance dividend history holdings and portfolio stats. The Bloomberg Barclays US Aggregate Bond Index or the Agg is a broad base market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States.

The reason the firm chose this index Caroline-Laure Negre fixed income manager at Vanguard says is because it gives a better gauge of liquidity in the market as it removes holdings that.

Bloomberg Barclays Indices track total returns. Benchmark Index The Bloomberg Barclays Global Aggregate Bond Index Distribution Frequency Semi-Annual Securities Lending Return as of Dec 31 2020 000 ISA Eligibility Yes. Dollar denominated investment-grade debt. The Bloomberg Barclays US Aggregate Bond Index ticker. 135144 034 038 449. The Bloomberg Barclays US Aggregate Bond Index or the Agg is a broad base market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States.

No adjustment is made to the hedge during the month to account for price movements of constituent securities in the returns universe of the index. As of 02052021 EDT. Bloomberg Indices may be. The reason the firm chose this index Caroline-Laure Negre fixed income manager at Vanguard says is because it gives a better gauge of liquidity in the market as it removes holdings that. Bloomberg Barclays Global-Aggregate Total Return Index Value Unhedged USD.

Source: investopedia.com

Source: investopedia.com

Treasuries quasi-governments corporates taxable municipal bonds foreign agency supranational federal agency and non-US. Benchmark Index The Bloomberg Barclays Global Aggregate Bond Index Distribution Frequency Semi-Annual Securities Lending Return as of Dec 31 2020 000 ISA Eligibility Yes. As of 02052021 EDT. Dollar denominated investment grade bond market which includes investment grade government bonds investment grade corporate bonds mortgage pass through securities commercial mortgage backed securities and asset backed securities that are publicly for sale in the United States. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

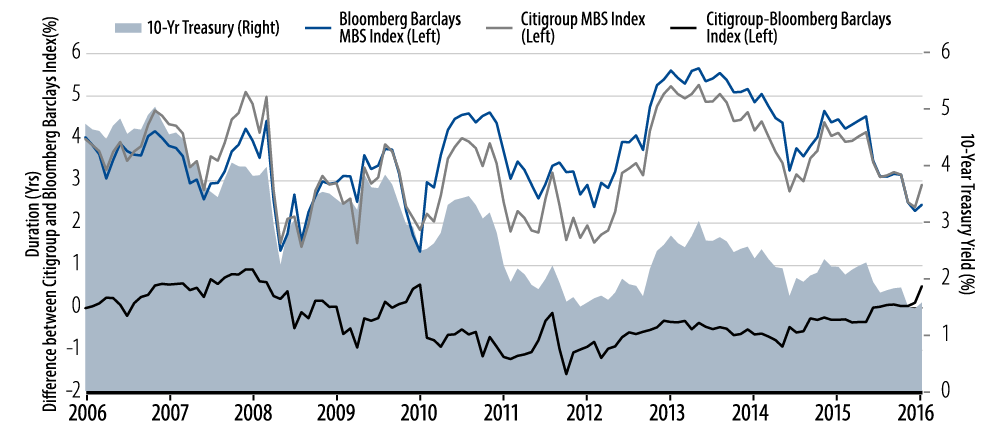

Source: westernasset.com

Source: westernasset.com

Get free historical data for SPAB. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Municipal Bond Index. IShares Core US Aggregate Bond ETF AGG 11687 -012 -010 USD Feb 11 1700. The index provides a measure of the performance of the US.

Source: seekingalpha.com

Source: seekingalpha.com

In addition to investment grade corporate debt the index tracks government debt. Performance data is based on the net asset value NAV of the ETF which may not be the same as the market price of the ETF. Aggregate Bond Index is designed to measure the performance of publicly issued US. The Aggs duration extension comes with less yield cushion as yields have dropped in this low interest rate environment. The index invests in a wide spectrum of public investment-grade taxable fixed income securities in the United States including government corporate and international dollar-denominated bonds as well as mortgage-backed and asset-backed securities all with maturities of more than 1 year.

No adjustment is made to the hedge during the month to account for price movements of constituent securities in the returns universe of the index. The index measures the performance of the US. Dollar denominated investment grade bond market which includes investment grade government bonds investment grade corporate bonds mortgage pass through securities commercial mortgage backed securities and asset backed securities that are publicly for sale in the United States. The Bloomberg Barclays US Aggregate Bond Index or the Agg is a broad base market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. Bloomberg Barclays Indices track total returns.

Source: newfinancemagazine.com

Source: newfinancemagazine.com

Investment grade bond market. The index provides a measure of the performance of the US. The index measures the performance of the US. Bloomberg Indices may be. The Aggs duration extension comes with less yield cushion as yields have dropped in this low interest rate environment.

Going back to 2004 the duration of the Aggregate was shorter 477 years versus 573 today and the yield was higher 464 versus 249. Performance data is based on the net asset value NAV of the ETF which may not be the same as the market price of the ETF. IShares Core US Aggregate Bond ETF AGG 11687 -012 -010 USD Feb 11 1700. No adjustment is made to the hedge during the month to account for price movements of constituent securities in the returns universe of the index. Bloomberg Indices may be.

The index provides a measure of the performance of the US. Aggregate Bond Index is designed to measure the performance of publicly issued US. The US giant tracks the Bloomberg Barclays Global Aggregate Float-Adjusted and Scaled index as opposed to the Barclays Bloomberg Global Aggregate Bond index. Performance is shown on a Net Asset Value NAV basis with gross income reinvested where applicable. The Aggs duration extension comes with less yield cushion as yields have dropped in this low interest rate environment.

Source: bogleheads.org

Source: bogleheads.org

In depth view into AGG iShares Core US Aggregate Bond ETF including performance dividend history holdings and portfolio stats. In depth view into AGG iShares Core US Aggregate Bond ETF including performance dividend history holdings and portfolio stats. The index measures the performance of the US. Performance is shown on a Net Asset Value NAV basis with gross income reinvested where applicable. Since August 24th 2016.

Source: pinebridge.com

Source: pinebridge.com

Currency-denominated bond in the index into the reporting currency terms. Debentures covered bonds and residential mortgage. The Bloomberg Barclays US Aggregate Bond Index ticker. Calendar The Global Aggregate Index is a global multi -currency index that is generated every business day of the year except. 135144 034 038 449.

The Aggs duration extension comes with less yield cushion as yields have dropped in this low interest rate environment. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Bloomberg Barclays Global-Aggregate Total Return Index Value Unhedged USD. The index is part of the SP AggregateTM Bond Index family and includes US. The Bloomberg Barclays US Aggregate Bond Index or the Agg is a broad base market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title barclays global aggregate bond index historical returns by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.